Just like anywhere in the world, establishing a corporation in the Philippines involves specific requirements and processes that must be followed meticulously. With the Philippine economy experiencing significant growth and business-friendly reforms in place, this is an opportune time to consider expanding your company into this emerging market.

In this guide, we will research the crucial steps and key considerations to successfully register a corporation in the Philippines. From the necessary number of directors and officeholders to the regulations surrounding foreign equity ownership, forming a corporation in the Philippines requires careful attention to detail and adherence to legal guidelines.

Key Takeaways:

- Strategic Timing: With the Philippine economy on the rise and business climate reforms underway, now is an opportune time to expand your company and register a corporation in the Philippines.

- Revised Corporation Code: The Revised Corporation Code in the Philippines aims to simplify company incorporation, making it easier and with fewer restrictions for businesses looking to establish a presence in the country.

- Requirements for Incorporation: When incorporating a company in the Philippines, ensure you have the necessary executive breakdown, including directors, officeholders, and a compliance officer, with certain residency requirements for key roles.

- Foreign Equity Possibilities: A domestic corporation in the Philippines may have foreign equity up to certain percentages, providing opportunities for foreign investors to participate in the country’s business landscape.

- Opportunities for Growth: By setting up a corporation in the Philippines, businesses can tap into a growing market, benefit from economic growth, and position themselves strategically in Southeast Asia.

Eligibility Criteria for Incorporating a Corporation in the Philippines

Types of Corporations

One of the key aspects to consider when incorporating a corporation in the Philippines is the type of entity you wish to establish. There are several options available, including stock corporations, non-stock corporations, and one-person corporations. Each type has its own set of rules and regulations, so it is crucial to determine which best suits your business needs. Assume that you have a clear understanding of the differences between these types before proceeding with the registration process.

| Stock Corporations | Non-Stock Corporations |

| Owned by shareholders who hold stocks | Operate for purposes other than profit |

| Shareholders have voting rights | Members may not receive dividends |

| Subject to regulations by the Securities and Exchange Commission | Regulated by specific laws depending on their purpose |

| Common in business ventures | Typically used for organizations like clubs, churches, or charities |

Basic Requirements Overview

Philippine business laws have specific requirements that must be met in order to successfully incorporate a corporation. These include securing a minimum of five (5) to fifteen (15) incorporators, appointing key officers such as a resident Corporate Secretary and Treasurer, and ensuring compliance with all government regulations, besides the allowance by law of one person corporation Overview, the process can be complex, but with the right guidance and understanding of the corporate code, establishing a corporation in the Philippines can be a prosperous venture.

Pre-Registration Tips and Best Practices

To ensure a smooth and successful registration process for incorporating a company in the Philippines, it is crucial to follow some pre-registration tips and practices. These steps will help you set a strong foundation for your business and navigate through the regulatory requirements seamlessly.

How to Choose the Right Business Name

An important first step in registering a corporation is choosing the right business name. The name should be unique, not already in use by any existing entity, and must comply with the guidelines set by the Securities and Exchange Commission (SEC). It is recommended to have several options in case your preferred name is unavailable. Make sure that the chosen name reflects the nature and goals of your business.

Importance of a Comprehensive Business Plan

Little can be achieved without a comprehensive business plan. This document outlines your business objectives, strategies, financial projections, and market analysis. It serves as a roadmap for your company’s growth and guides decision-making processes. A well-thought-out business plan demonstrates your commitment to success and can attract potential investors and partners.

It is necessary to dedicate time and effort to developing a robust business plan that aligns with your vision and goals for the corporation. A carefully crafted plan can set your business apart from competitors and help you secure funding for your operations and expansion.

Tips for Determining the Business Structure

- Research different business structures to determine the most suitable option for your company.

- Consider the tax implications of each business structure to optimize financial efficiency.

After thorough consideration, choose the business structure that best aligns with your long-term goals and operational needs. Ensuring the right structure from the start can impact your company’s growth and success in the future.

Now, understanding the nuances and implications of each business structure is necessary to making an informed decision about the incorporation of your company in the Philippines. After all, your chosen structure will influence your company’s governance, tax obligations, and liability considerations.

Understanding the Role of a Corporate Secretary

Assuming the role of a corporate secretary is critical in maintaining compliance with regulatory requirements and ensuring smooth operations within the company. The corporate secretary is responsible for documentation, record-keeping, and communication with government agencies. Understanding the duties and responsibilities of this position is necessary for corporate governance and transparency.

Tips on Selecting Your Incorporation Agents

- Research potential incorporation agents to ensure they have a good reputation and experience in the field.

- Consider the services offered by incorporation agents to meet your specific needs and requirements.

Even after you have determined the business structure, selecting the right incorporation agents plays a crucial role in the registration process. Perceiving the key responsibilities of incorporation agents and their impact on your company’s incorporation journey is vital for a successful and compliant registration process.

Detailed Requirements for Incorporating a Company in the Philippines

All companies looking to incorporate in the Philippines must adhere to specific requirements to ensure compliance with local laws. Here is a breakdown of the key components you need to consider when establishing a corporation in the country.

Executive Breakdown

With regards to the executive structure of your company, there are several key positions that need to be filled. As per Philippine regulations, a corporation should have two to 15 directors or incorporators, with a majority residing in the Philippines. Additionally, you must appoint a President, who serves as the company’s signatory and does not necessarily have to be a resident of the Philippines. The Corporate Secretary, responsible for the company’s administration, must be a resident, along with the Treasurer handling financial matters, and a Compliance Officer to ensure adherence to corporate guidelines.

Determining Your Company’s Foreign Equity

Company ownership in the Philippines may involve foreign equity categorized into different brackets. Your domestic corporation could have foreign equity ranging from below 40% to over 40.01%. Understanding the allowable foreign ownership percentages in your company is crucial for compliance with local regulations and ensuring a smooth incorporation process.

The percentage of foreign equity in your company plays a significant role in dictating the extent of international involvement permitted in your business operations in the Philippines. It is imperative to carefully assess and determine the appropriate level of foreign ownership based on the nature of your business and the industry in which you operate.

Capital Requirements and Tips for Compliance

In the matter of capital requirements for incorporating a company in the Philippines, it is vital to ensure that your organization meets the necessary financial thresholds. This includes the requirements for initial investment capital, paid-up capital, and capital stock as set forth by local laws. After fulfilling these capital obligations, you can proceed with the incorporation process smoothly.

- Ensure that your paid-up capital is sufficient for your business operations.

- Comply with the minimum capitalization requirements set by the Philippine regulatory authorities to avoid any legal complications later on.

Preparing the Necessary Documents

Articles of Incorporation

Necessary documents for registering a corporation in the Philippines include the Articles of Incorporation. This document outlines the company’s basic information, such as its name, purpose, principal office address, shareholder details, and capital structure. The Articles of Incorporation must comply with the laws set forth by the Revised Corporation Code of the Philippines, which aims to streamline the process for company formation to attract more investors.

Corporate By-laws

Essential documents for incorporation also include the Corporate By-laws, which serve as the internal rules for the corporation’s governance. This document outlines how the company will operate, including roles and responsibilities of directors, officers, and shareholders. Corporate By-laws are necessary to ensure smooth operation and compliance with Philippine regulations.

It is imperative that the Corporate By-laws are carefully crafted and tailored to the company’s specific needs to avoid any legal complications in the future. Companies should consult legal professionals to ensure that their By-laws align with Philippine corporate laws and best practices.

Additional Required Documents

Little Known to many, additional required documents may include a Treasurer’s Affidavit, a Certificate of Deposit from a local bank certifying the paid-up capital, a Foreign Investment Application form if applicable, and other supporting documents as requested by the Securities and Exchange Commission (SEC) of the Philippines. Having all the necessary paperwork ready and in order is crucial to a smooth and successful incorporation process.

Documents submitted should be accurate, up-to-date, and comply with SEC requirements to avoid any delays or rejections in the registration process.

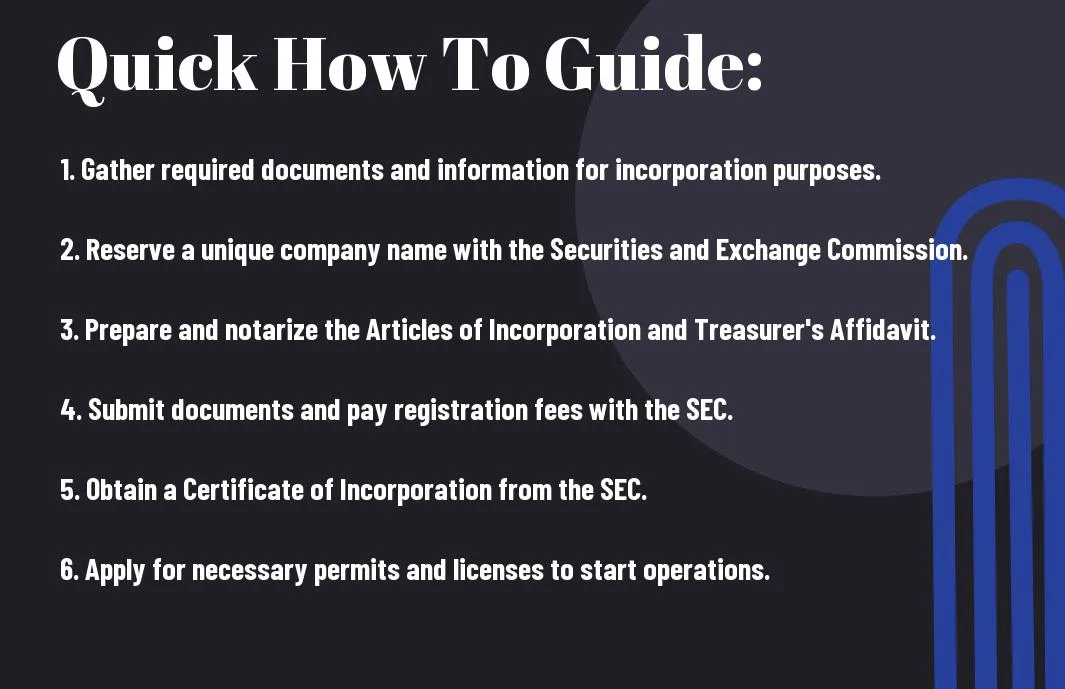

The Registration Process, Step-by-Step

How to Reserve Your Company Name

Even before starting the registration process, it is vital to reserve your company name with the Securities and Exchange Commission (SEC). The reservation process ensures that no other entity can use the chosen name, helping to establish your brand identity.

Registering with the Securities and Exchange Commission (SEC)

Registration with the Securities and Exchange Commission (SEC) is a crucial step in incorporating your corporation. This process involves submitting the necessary documents and information to the SEC, including the Articles of Incorporation and By-Laws, to officially register your company as a legal entity.

Barangay Clearance: How to Obtain and Its Significance

Process for obtaining a Barangay Clearance is imperative to show compliance with local barangay regulations and obtain clearance from the barangay authorities. This clearance serves as proof that your company is permitted to operate in the specific barangay jurisdiction.

Acquiring the Mayor’s Business Permit

Any company operating in the Philippines must acquire the Mayor’s Business Permit from the local government office. This permit validates your business operation within the city or municipality and ensures compliance with local ordinances and regulations.

Registering with the Bureau of Internal Revenue (BIR)

Your company’s registration with the Bureau of Internal Revenue (BIR) is mandatory for tax compliance. This submission process involves providing the necessary documents and details to establish your tax obligations and ensure adherence to tax laws in the Philippines.

Employer Registration with SSS, PhilHealth, and Pag-IBIG

Step-by-step registration with the necessary government agencies, such as the Social Security System (SSS), PhilHealth, and Pag-IBIG Fund, is crucial for employer compliance with social security and housing fund contributions. Registering your company ensures that your employees receive the benefits and coverage they are entitled to.

A mayor’s permit may be required for certain businesses and may have specific requirements and regulations that need to be followed. It is important to thoroughly understand and adhere to these regulations to operate legally and smoothly within the Philippines.

Post-Registration Factors and Compliance

After successfully incorporating a company in the Philippines, it is crucial to adhere to post-registration factors and compliance requirements to ensure smooth operations and legal standing. Understanding the company’s tax obligations, annual reportorial requirements, maintaining good standing with regulatory bodies, and adhering to auditing and financial-reporting standards are important for the sustainability and growth of your business.

Understanding the Company’s Tax Obligations

On the tax front, it is vital for corporations in the Philippines to comply with their tax obligations to avoid penalties and legal issues. Companies must stay updated on tax regulations, file accurate tax returns, and ensure timely payment of taxes to the Bureau of Internal Revenue (BIR).

Annual Reportorial Requirements

With annual reportorial requirements, corporations in the Philippines must submit annual financial statements and general information to government agencies such as the Securities and Exchange Commission (SEC) and BIR. Failure to comply with these requirements can result in fines, penalties, or even dissolution of the business.

- File annual financial statements

- Comply with SEC and BIR regulations

- Update corporate records regularly

Plus, keeping up with the annual reportorial requirements demonstrates corporate transparency and responsible governance, which can build trust with stakeholders.

Tips for Maintaining Good Standing with Regulatory Bodies

Annual compliance reviews and document audits are vital for corporate entities in the Philippines to maintain good standing with regulatory bodies. Regularly reviewing and updating corporate records, ensuring compliance with laws and regulations, and promptly addressing any issues that arise are key to staying in good standing.

- Regular compliance reviews

- Document audits

- Prompt issue resolution

This proactive approach in addressing compliance matters is important for perceiving potential risks and avoiding any legal complications.

Auditing and Financial-Reporting Standards

Reportorial compliance includes adhering to auditing and financial-reporting standards set by regulatory bodies in the Philippines. Companies must engage a licensed external auditor and prepare financial statements following generally accepted accounting principles to ensure accuracy and transparency.

Tips for reporting accurate financial data and maintaining compliance with auditing standards include maintaining detailed records, conducting regular internal audits, and seeking professional guidance when needed.

Opening Corporate Bank Accounts

Requirements for Opening a Corporate Bank Account

Now, when it comes to opening a corporate bank account in the Philippines, there are specific requirements that you need to fulfill. An important requirement is that the corporation must be duly registered with the Securities and Exchange Commission (SEC) and have a valid Certificate of Registration. Additionally, you will need to provide proof of identification for the authorized signatories and present the company’s Articles of Incorporation and By-Laws.

How to Choose a Bank for Your Business

Now, choosing the right bank for your business is crucial, as it will be the financial partner of your corporation. An important consideration is to assess the bank’s reputation, stability, and services offered. It is advisable to choose a bank that aligns with your company’s financial goals and has a strong track record of supporting businesses in the Philippines.

A necessary factor to consider when selecting a bank for your business is the bank’s accessibility and convenience. You want to ensure that the bank’s locations and online banking services meet your company’s needs efficiently. Moreover, take into account the bank’s fees, interest rates, and additional services that can benefit your corporation in the long run.

Tips on Managing the Corporation’s Finances

- Monitor Cash Flow: Keep track of your company’s income and expenses regularly.

- Set Budgets: Establish financial plans to allocate resources effectively.

- Invest Wisely: Make informed decisions on where to invest company funds.

You must also prioritize the corporation’s financial health by keeping a close eye on its cash flow, setting realistic budgets, and making wise investments. Perceiving the financial landscape of the Philippines and understanding the market trends will play a crucial role in ensuring the corporation’s success.

Other Registrations and Special Licenses

Identifying If You Need Special Licenses

Despite the streamlined process of incorporating a corporation in the Philippines, there are still regulations that need to be followed. An important aspect to consider is whether your business requires any special licenses or permits to operate legally. Depending on the nature of your industry, specific licenses may be necessary to ensure compliance with the law.

How-to Guide for Industry-Specific Registrations

Clearly, different industries have varying requirements when it comes to registration and licenses in the Philippines. An understanding of the specific regulations and procedures for your industry is crucial for a smooth incorporation process. It is advisable to research industry-specific guidelines and seek professional assistance if needed to navigate the registration process efficiently.

A thorough understanding of industry-specific registrations can help you avoid potential roadblocks and ensure compliance with local laws. Knowing the requirements for your specific sector will facilitate a successful registration process for your corporation in the Philippines.

Intellectual Property Registration Tips for Your Brand

The protection of intellectual property is crucial for the success of any business in the Philippines. A proper registration of your brand, trademarks, and patents can safeguard your creations from infringement and unauthorized use. Knowing the process and requirements for intellectual property registration is imperative for protecting your business assets.

- Tips for Intellectual Property Registration:

- Ensure to register your trademarks and patents with the relevant authorities.

- Consult with legal experts to understand the nuances of intellectual property laws.

- Knowing the importance of intellectual property protection can prevent costly legal disputes.

Why is 2024 a strategic year for business expansion in the Philippines?

Economic Growth and Investment Incentives

Many businesses are looking towards the Philippines as a strategic location for expansion in 2024 due to the country’s robust economic growth. The Philippine economy is proving to be resilient despite global risks. The growth trajectory presents a lucrative opportunity for companies seeking to establish a business presence in the Philippines.

The Philippine Innovation Act and its Implications

Some significant changes have been observed in the Philippine business landscape, particularly with the introduction of the Philippine Innovation Act. This act emphasizes the importance of fostering innovation and technological advancement in the country’s business sector. On top of that, it aims to streamline processes and create a more conducive environment for businesses to thrive, enhancing competitiveness in the global market.

On a futuristic note, the Philippine Innovation Act is a pivotal step towards positioning the country as a hub for innovation and technology-driven enterprises. By incentivizing research and development activities and promoting a culture of innovation, businesses can leverage these opportunities to stay ahead of the curve and drive growth.

Leveraging ASEAN Integration

A common theme among businesses eyeing expansion in the Philippines is the strategic advantage of leveraging ASEAN Integration. With the Philippines being a part of the ASEAN region, businesses can capitalize on the benefits of seamless trade, investment, and collaboration within this economic bloc. This integration opens doors to a larger market, enhanced connectivity, and increased opportunities for business growth.

Businesses exploring expansion in the Philippines in 2024 or thereafter should consider the potential advantages offered by ASEAN integration, as it can facilitate smoother operations, market access, and synergies with neighboring countries.

Summing Up

Registering a corporation in the Philippines involves complying with specific requirements set by the government. With the Revised Corporation Code making the process more straightforward, it is an opportune time to expand your business into this growing economy. By following the guidelines on incorporating a company, such as having the required number of directors, officeholders, and ensuring compliance with foreign equity limits, you can successfully establish your presence in the Philippines.

Remember to consult with legal and business experts to ensure that you are following all necessary steps and regulations. With the right approach and preparation, incorporating a company in the Philippines can be a strategic move towards growth and success in the Southeast Asian region. Take advantage of the favorable business climate and start the process of incorporating your company in the Philippines today.

FAQ: How to Register a Corporation in the Philippines?

Q: What is the process of registering a corporation in the Philippines?

A: The process involves securing all necessary documents, such as articles of incorporation, by-laws, treasurer’s affidavit, and other requirements. These documents need to be submitted to the Securities and Exchange Commission (SEC) for approval.

Q: What are the requirements for incorporating a corporation in the Philippines?

A: The requirements typically include having at least 5 incorporators, majority of whom need to be residents of the Philippines, as well as appointing a corporate secretary, treasurer, and compliance officer. Foreign equity may be allowed up to a certain percentage.

Q: How long does it take to register a corporation in the Philippines?

A: The process of registering a corporation in the Philippines usually takes around 2-4 weeks, depending on the completeness of the documents submitted and the efficiency of government processing.

Q: What are the benefits of incorporating a corporation in the Philippines?

A: By incorporating a corporation, businesses in the Philippines gain limited liability protection, separate legal entity status, potential tax benefits, access to more financing options, and increased credibility in the market.

Q: Are there any restrictions on foreign ownership when registering a corporation in the Philippines?

A: Foreign equity in a corporation in the Philippines may be limited to certain percentages, depending on the type of industry. It’s important to comply with the Foreign Investment Negative List (FINL) to ensure compliance with the regulations.